New vehicle shortages are pushing used RV values to historical highs, just as the nation’s travel season opens its doors.

A new J.D. Power report found a “red hot” first quarter in all RV and travel trailer segments, rolling off from the COVID-19 pandemic’s impact on travel-seeking consumers. New RVs are a rarity on today’s dealer lots.

“I anticipated manufactures would have ramped up production more to meet demand, but not all of them are,” said the company’s VP of business development and strategy, Lenny Sims. “Some do not want to build a tremendous number of new units and are a bit conservative. That influence comes from somewhere else, too – people do not need RVs like we need a car. The RV boom came about as the [pandemic] situation did.”

Limited new units are not the only pandemic-fueled trend driving a spike in unit values. J.D. Power’s first quarter Market Insights credited rising employment rates and positive consumer attitudes as factors in continuing RV demand.

“You need consumers to have a lot of positivity and confidence,” Sims said. “If they do, [the influx] should continue.

“The economy is what we are watching the most,” he said. “It is something that could go one way or the other, and whichever way it goes, will generally influence the RV market.”

Smaller vehicles saw the highest jump, with camping trailer values averaging 35.5% higher in 2021. Last year’s report, which compared 2020 values with 2019, saw a 2.6% increase in the segment. Truck campers’ 2021 values ran 29.3% ahead of 2020 values.

Spring and summer months typically spark more interest in RVing and getting outdoors. However, a year-over-year comparison has numbers exceeding expectations, Sims said.

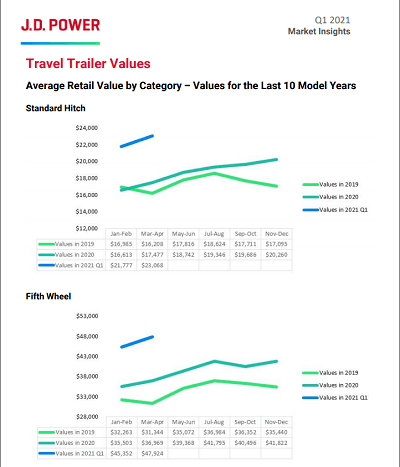

Looking at travel trailers, standard hitch values averaged 34.5% higher in this year’s Q1 compared with 2020’s first quarter. Fifth wheel units “crushed” year-over-year comparisons as well, the report stated, running 28.7% higher in 2021.

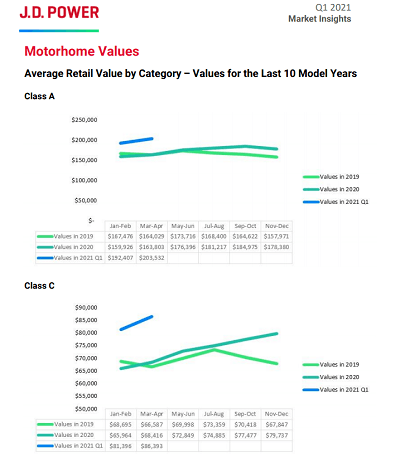

On the motorhome side, Type A models came in 22.3% higher and Type C units rose 24.9% year-over-year. Last year, those numbers were 4.9% and 5.4%, respectively.

Predictions for how long highs will stick are less certain. A changing economy following the pandemic means a few “elephants” are in the room, Sims said.

“Quarantine became an issue for most people – an RV or boat was an escape,” he said. “Camping was an escape to get away from people and be safe. But now people are starting to go back to work. The economy is supposed to be changing, and an RV that served a purpose for a work environment might not work out too well anymore.”

Sims talked potential consumer trends if the economy took a downward turn, such as monthly RV payments – which could average $1,000 or more with insurance and storage fees, depending on the unit – becoming problematic for families watching expenses.

“One thing is for sure, it will be an interesting watch this year,” Sims said in regard to the economy. “You cannot forget that the boom came from the pandemic. If the pandemic was big enough to influence the industry in a positive way, it can also have a negative influence.”

J.D. Power’s report found web traffic trends evident of a new buyer influx. Traffic took a dip from 2020’s end into this year. Sims said the results show new buyer habits when searching online for units.

“We see this influx of brand-new buyers doing research,” Sims said of traffic peaking last summer. “Once they do that research, they get to a point where they decide as a family unit that they want a [certain unit], which is phase two. In some cases, you might then see a transition in research traffic focused on inventory-type sites, or even peer-to-peer rental sites.”

Web traffic is a “moving target” that ebbs and flows, Sims said, but consumers’ future actions are being analyzed carefully.

“I anticipate traffic building through the fall, but it is hard to say,” Sims said. “There are so many unknowns, and I do not know how sticky the line of new buyers is.”

Moving forward, Sims said the RV industry is looking good and has potential to stay on the upswing. J.D. Power is watching factors that may impact the industry, including consumer attitudes based on factors such as COVID-19 vaccinations.