More than 27,000 recreational customers engaged in a technology provider’s study in late summer of 2023.

Rollick’s “Future of Buying” study, published in January, provides insight into customer engagement, trends and desires across the RV, marine and powersports industries.

Rollick Chief Revenue Officer Jason Nierman said the study details how consumers get to dealers and what they want to do once they arrive.

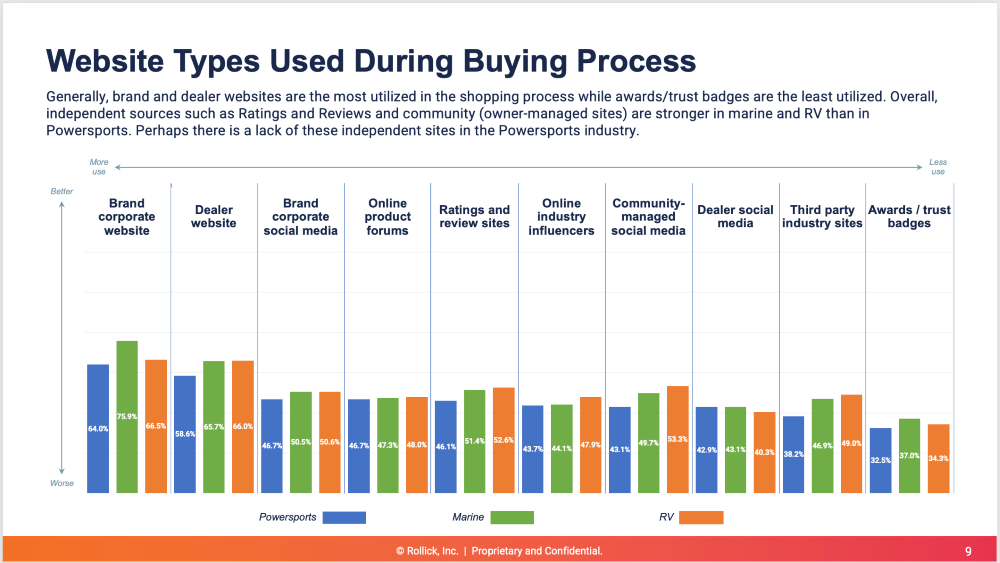

The journey to purchase any product often begins with research. The study broke down which websites customers visit most often as they embark on their research journey.

Across all recreational industries, manufacturer (or brand) websites were visited the most, ratings and review pages were second and dealer websites were third.

Nierman said the RV segment saw 66.5% of customers visit manufacturer sites, 66% visit the dealer site and 52.6% visit ratings and review sites.

The manufacturer and dealer site numbers were more even in the RV segment. Nierman attributed these to the multitude of decision points when buying an RV.

“If you are thinking about buying an RV, the first thing you may want to do is go to a brand’s site,” Nierman said. “You want to understand the models, you want to see the unique features of it. Then, obviously, you need to see the dealer inventory. So, then you got to a dealer website and then you can compare that brand to other brands.”

An emerging RV manufacturer trend is to integrate dealer information onto their sites. Rollick provides manufacturers programs to execute this. The feature provides the consumer information all in one place while still directing the consumer to the dealer.

“A consumer can actually locate local inventory there,” Nierman said, “rather than going to a dealer site.”

First Point of Contact

Rollick’s study confirmed speedy responses and continuous communications are valued in the digital age.

Nierman said dealers often find themselves on busy days with a million tasks to complete. This makes immediate responses difficult.

Rollick and other providers provide nurture services. The services will pick up leads and send an automatic message or email to customers. The goal is to secure a consumer appointment, where the dealer can dedicate time to the consumer’s needs. Around 850 recreational dealers use the Rollick Nurture program.

Nierman said email remains the best way to contact customers.

Moving Online

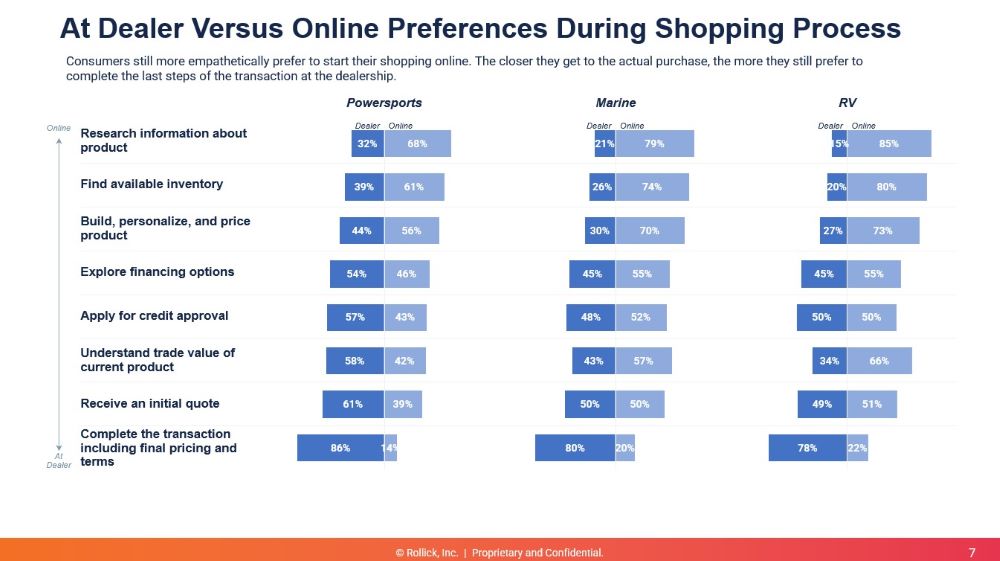

Reporting on growing technology features and tools, the Rollick report displayed the customer’s desire to do more online.

For the RV industry, 85% of consumers want to research information about an RV online. The report found 80% of consumers want to find available inventory online and 73% want to build, personalize and price the product online. More than half of participants (55%) expressed a desire for exploring digital finance options. Half said they would prefer to apply for credit online.

Sixty-six percent of participants wanted to understand their trade-in value value online and 51% would like to receive an initial quote digitally. Only 22% reported wanting to complete the transaction, including final pricing and terms, online.

Companies such as Rollick provide digital retail functionalities to dealers to integrate services into dealers’ websites to enhance consumer engagement.

Nierman said, “Take this data and use it to guide how your website digitally engages the consumer.”