The Rev Group reported its fourth quarter sales fell overall by 4.3% from the same period in 2020 for a net sales of $589.9 million.

Despite the overall decrease, the company’s recreation segment reported an increase of net sales to $2.179 million and a 129% backlog growth this quarter. The recreation segment’s backlog grew 6.6% from the third quarter despite the manufacturer saying it increased fourth-quarter shipments.

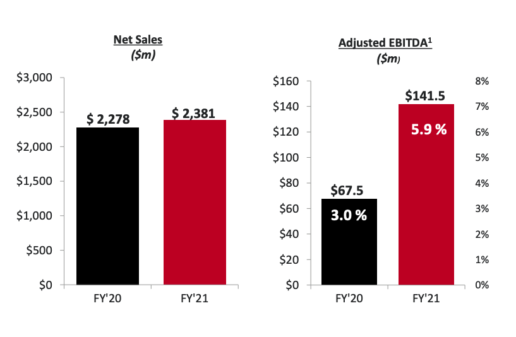

Rev Group President and CEO Rod Rushing noted several accomplishments for the year’s end, including a fourth quarter of year-over-year improvement to adjusted earnings before taxes, interest, taxes, depreciation and amortization.

“Our record $3.1 billion (total) backlog combined with the significant progress we have made building our operational capabilities have positioned us well to continue to improve our performance and create shareholder value,” Rushing said.

Net sales increased by 12.2% from the fourth quarter of 2020, driven mainly by the company’s motorized units, Rev Group reported.

The company increased its Type B and C unit shipments throughout the quarter, but also increased its overall recreation backlog to $1.2 billion. The company said retail sales continue to outpace wholesale shipments in most categories, despite there being 70% to 80% less inventory on dealer lots compared with peak inventory numbers.

Mark Skonieczny, Rev Group’s chief financial officer, said the backlog was the sixth consecutive record.

“Reception for our brands has never been stronger,” he said.

Motorized units prices increased, partially to offset material inflation and freight cost surcharges. However, the segment’s performance was impacted by inefficiencies in the supply chain and labor constraints, Rev Group reported.

Skonieczny said employee out-of-plant rates have been high due to COVID-19 positive tests and safety protocols.

“For example, our Type A employee out-of-plant rates have been approximately 15%,” Skonieczny said. “Many of our suppliers have faced similar conditions compounding supply chain shortages. As a result, our recreation businesses have had to do off-line work on anywhere from 70% to 95% of units within the quarter, depending on location.”

The company reported material and labor shortages limited line rates for Type A and towable units, slowing production. The company projects material and chassis shortages will continue to slow throughput and net sales in the first half of fiscal 2022.

The company also cited limited chassis visibility in gas and diesel products.

Skonieczny said full-year sales increase in the recreation segment resulted from increased demand and throughput, plus pandemic-related prior year softness.